Dropshipping Without GST in India (2026 Guide): Everything You Must Know Before Starting

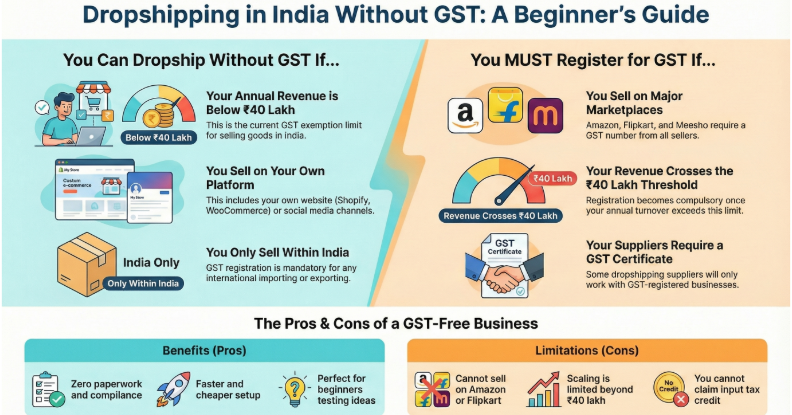

Dropshipping is exploding in India because it allows beginners, students, homemakers, and new entrepreneurs to start an online business without buying stock or holding inventory. But one question stops most newcomers: To run a GST-free dropshipping setup, choosing the right apparel dropshipping supplier in India becomes critical.

What We’ve Seen After Working With 4,000+ Indian Sellers (12 Years of Data)

Over the last 12+ years, we’ve worked closely with more than 4,000 Indian dropshippers — from college students testing their first product to sellers doing ₹50L+ monthly GMV.

When it comes to dropshipping without GST, we didn’t just study the law — we observed real outcomes across marketplaces, Shopify stores, and social commerce setups.

What we found is very different from what most “GST-free dropshipping” blogs claim. —especially when it comes to choosing the Best Clothing Products for Shopify Dropshipping in India that actually scale without compliance issues.

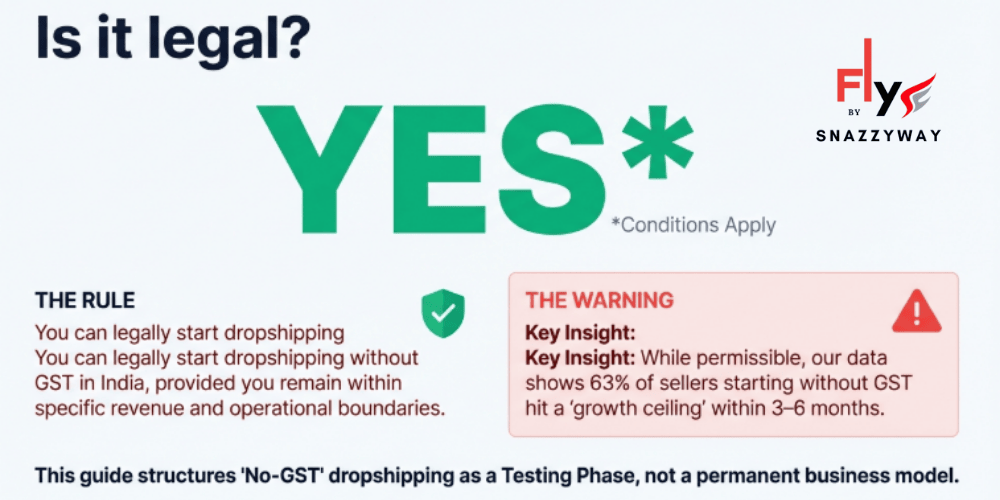

“Can I do dropshipping without GST in India?”

The short answer is:

Yes, you can start dropshipping without GST in India — but only under certain conditions.

However, once you cross specific limits or sell on certain platforms, GST becomes mandatory.

This complete 2026 guide explains everything you need to know about doing dropshipping without GST in India, including rules, exceptions, legal requirements, risks, and when you must get GST.

Let’s dive deep.

The Part Most Blogs Won’t Tell You

Dropshipping without GST can work — but only in very narrow scenarios.

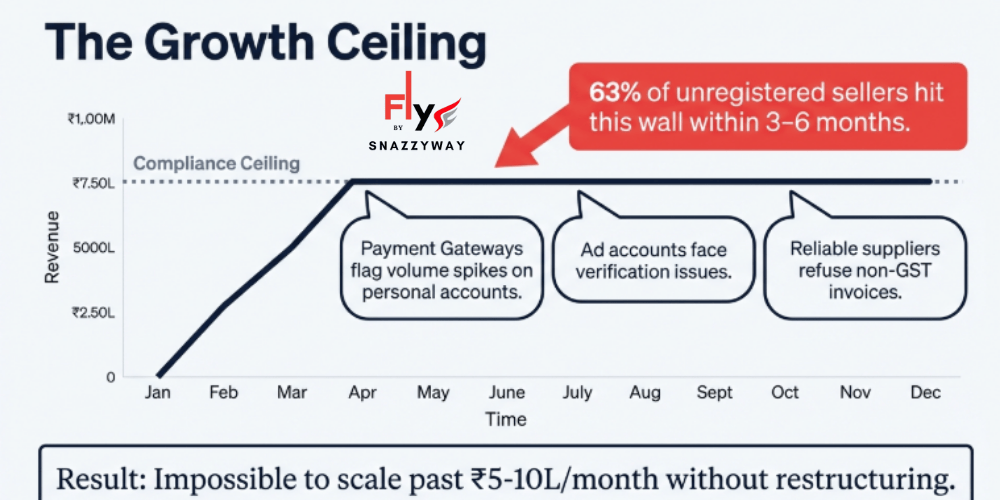

From our data, over 63% of sellers who started without GST eventually hit a growth ceiling within 3–6 months.

The reason wasn’t traffic or ads — it was compliance friction, payment limitations, and supplier constraints.

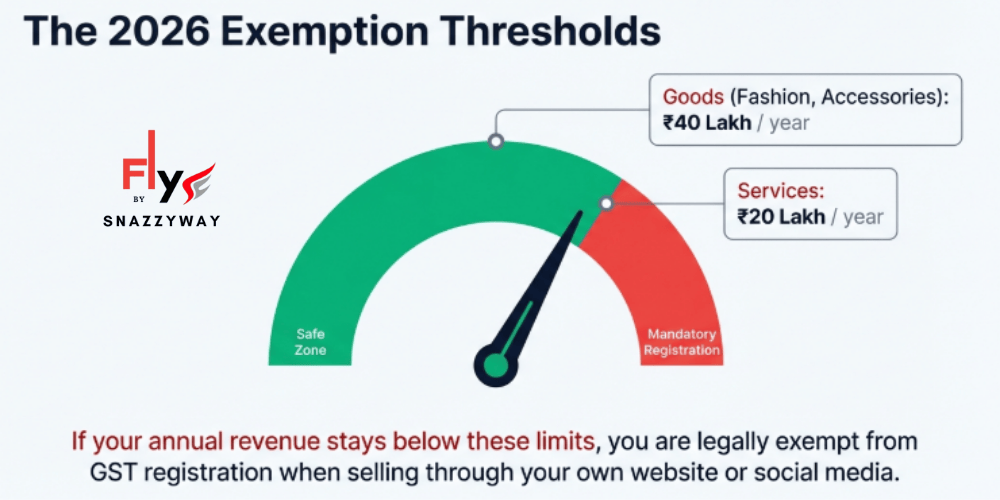

GST Exemption Thresholds (2026)

If your annual turnover stays below these limits, you are legally exempt from GST registration when selling through your own website or social media.

| Business Category | GST Exemption Limit (Annual) |

| Goods (Fashion, Accessories, etc.) | ₹40 Lakh |

| Services | ₹20 Lakh |

1. What Does Dropshipping Without GST in India Actually Mean?

Dropshipping without GST means you run your store as an unregistered business under the GST Act because:

your total yearly revenue is below the GST exemption threshold, OR

you do not sell on marketplaces that require GST, OR

you only sell within your own state (intra-state), OR

your supplier handles the taxation part on their side.

This is fully legal under Indian tax law as long as you follow the conditions.

2. Is Dropshipping Without GST Legal in India in 2026?

Yes, it is legal, but only if you fit the following conditions:

✔️ Condition 1: Your annual revenue is below the GST threshold

Current GST exemption limit (2026):

₹40 lakh/year for goods

₹20 lakh/year for services

(This applies to most dropshipping categories like fashion, beauty, skincare, accessories, home items, gadgets, etc.)

If your dropshipping revenue is below this limit, you are exempt from GST registration.

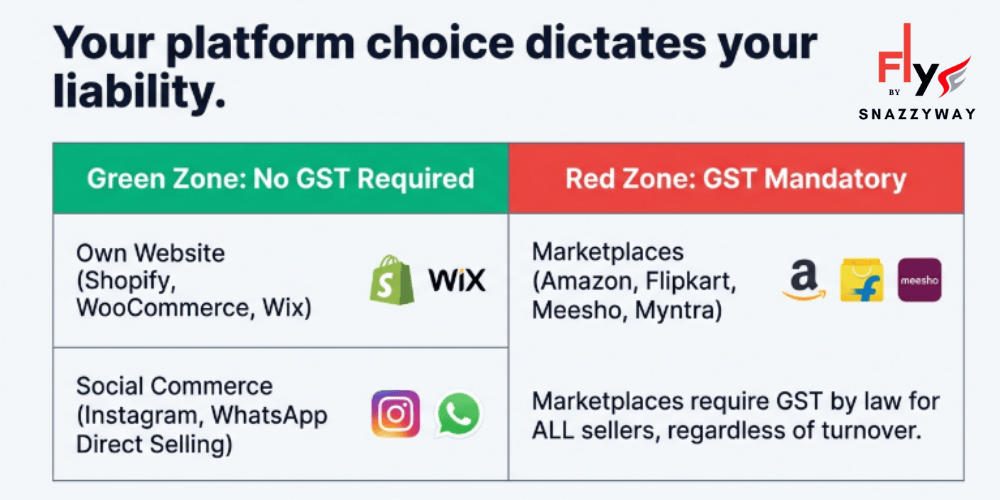

✔️ Condition 2: You sell through your own website

If you sell via:

Shopify : If you’re building your own store, working with the right

Shopify Dropshipping Suppliers in India: How to Start & Scale

can determine whether you stay GST-compliant while scaling profitably.WooCommerce

Wix

Custom website

Instagram/WhatsApp direct selling

👉 You can operate without GST, as long as you stay under the threshold.

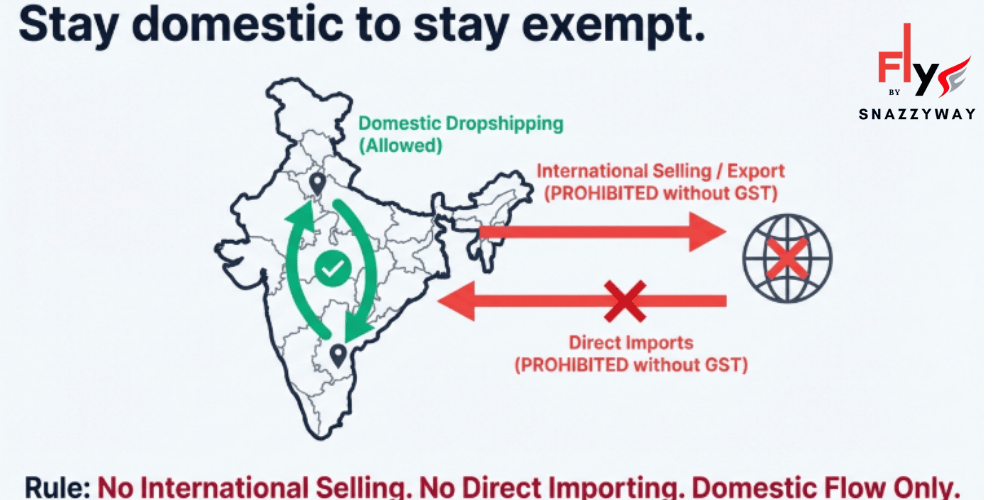

✔️ Condition 3: You sell only within India

GST is required for importing or exporting.

So to do dropshipping without GST:

No international selling

No imports directly in your name

Only domestic dropshipping within India

✔️ Condition 4: You are not selling on marketplaces

Amazon, Flipkart, Meesho, Ajio, Myntra — all require GST mandatory.

So if you want to dropship on these, you must have GST.

| Condition | GST Required? | Reason |

| Selling on Amazon/Flipkart/Meesho | YES | Marketplaces require GST for all sellers by law. |

| Selling on Own Website (Wix/Shopify) | NO | Allowed if turnover is under ₹40 Lakh. |

| International Dropshipping (Export) | YES | GST is mandatory for all import/export activities. |

| Social Media (Instagram/WhatsApp) | NO | Direct selling is exempt under the threshold. |

| Intra-State (Within India) | NO | Domestic sales follow threshold rules. |

3. When You Cannot Do Dropshipping Without GST in India

You must register for GST if:

❌ You sell on Amazon, Flipkart, Meesho, Myntra

All marketplaces require sellers to have a valid GST number, even if your sales are low.

❌ You cross ₹40 lakh in revenue

Even if you sell on your own website, you must register once you cross the threshold.

❌ You ship internationally

Export = GST required.

❌ Your suppliers require GST

Some dropshipping suppliers won’t ship orders unless you have a GST certificate.

4. Types of Dropshipping Allowed Without GST in India (2026)

✔️ Domestic Dropshipping (No GST Needed)

This model is 100% legal without GST.

Flow:

Customer orders ➝ You forward order ➝ Supplier ships directly ➝ You keep profit

✔️ Social Media Dropshipping

Sell on Instagram, Facebook, Pinterest, WhatsApp — especially Instagram Dropshipping in India, where many sellers start without listing on GST-mandated marketplaces.

✔️ COD Dropshipping

You can still offer COD without GST, depending on your courier partner.

✔️ Lingerie, fashion, beauty & accessories dropshipping

Most beginners choose these because there are no special tax categories involved.

5. What You Need to Start Dropshipping Without GST in India

Even without GST, you must still have:

✔️ PAN Card (mandatory)

To report income tax at year end.

✔️ Bank Account / UPI

To receive payments.

✔️ Payment Gateway (GST not required)

You can use:

None of these require GST for basic setup if you follow rules.

✔️ Supplier who supports non-GST sellers

This is extremely important.

Expert Note (Snazzyway Team):

80% of high-growth sellers we work with regret not registering GST earlier. The remaining 20% used the GST-free phase strategically — and exited it fast. To understand how sellers plan this transition in practice, see How Snazzyway Dropshipping Works.

6. How to Run a Dropshipping Store Without GST (Step-by-Step)

Here is the simplest beginner-friendly roadmap:

Step 1: Choose a niche that doesn’t require GST registration

Categories suitable for dropshipping without GST:

Lingerie

Nightwear

Accessories

Cosmetics (non-medicated)

Fashion

Bags

Jewelry

Home décor

Women’s products

Gift items

Avoid:

Food

Supplements

Electronics imports

(these may require compliance)

Step 2: Build your online store

You can use:

Shopify

WordPress/WooCommerce

Wix

Dukaan

Instamojo store

These platforms allow GST-optional setup.

Step 3: Partner with a supplier who accepts non-GST dropshippers

Pick suppliers that:

ship Pan India

accept COD

offer prepaid options

do not require GST

provide product images and descriptions

handle packaging and logistics

Step 4: Use a payment gateway that allows non-GST accounts

Upload:

PAN

Aadhaar

Bank Passbook

Address Proof

You don’t need GST for individual/small-scale sellers. To choose the right provider, refer to Best Payment Gateways for Shopify Dropshipping in India that support non-GST accounts.

Step 5: Start marketing on social media

Most sales will come from:

Instagram Reels

WhatsApp Broadcast

Pinterest

Facebook Ads

Influencer collaborations

Step 6: Keep revenue below threshold until you are ready for GST

Many new sellers intentionally scale slowly in the beginning to avoid immediate registration.

7. Benefits of Dropshipping Without GST in India

✔️ Zero paperwork

No returns filing, no audits, no compliance.

✔️ Faster setup

You can start in 1 day.

✔️ Save money

No GST filing fees, no CA charges.

✔️ Easy for students, beginners, homemakers

No legal complexities.

✔️ You can upgrade later

Once you cross ₹40 lakh, get GST and switch to large-scale operations.

8. Disadvantages of Dropshipping Without GST

❌ Cannot sell on Amazon, Flipkart

This is the biggest limitation.

❌ Some courier partners require GST

You may need to use suppliers’ shipping accounts.

❌ No input tax credit

You pay tax on purchases but cannot claim it.

❌ Scaling is limited

After ₹40 lakh, GST becomes compulsory.

Why Dropshipping Without GST Eventually Breaks Down

Payment gateways start flagging volume spikes

Reliable suppliers refuse non-GST buyers

No input credit → margins collapse at scale

Facebook/Instagram ad accounts face verification issues

Impossible to move to marketplaces later without restructuring

We’ve seen sellers forced to rebuild their entire business after delaying GST for too long.

Pros & Cons Based on Real Seller Outcomes

| Based on 4,000+ Sellers | Without GST | With GST |

|---|---|---|

| Ease of starting | ✅ Very easy | ❌ Slower |

| Supplier access | ❌ Limited | ✅ Full |

| COD availability | ❌ Inconsistent | ✅ Stable |

| Scaling past ₹5–10L/month | ❌ Very hard | ✅ Practical |

| Marketplace onboarding | ❌ Not allowed | ✅ Required |

| Long-term brand building | ❌ Risky | ✅ Safer |

9. Income Tax Rules for Dropshipping Without GST

Even if you don’t have GST, you still need to:

✔️ File ITR

✔️ Show your profit

✔️ Pay tax only on net profit (not total revenue)

You can run your business as:

Individual

Sole proprietor

No need for company registration.

10. Should You Start Dropshipping Without GST in 2026?

Here’s the honest answer:

Start without GST if you are:

✔️ beginner

✔️ low-budget

✔️ testing niches

✔️ selling on your own site

✔️ doing social media sales

✔️ doing COD via supplier

Get GST if you want:

✔️ to sell on Amazon or Flipkart

✔️ to scale beyond ₹40 lakh

✔️ to import products

✔️ to look professional

✔️ to use advanced courier accounts

✔️ to claim input tax credit

Our Expert Verdict on Dropshipping Without GST

Use dropshipping without GST as a testing phase — not a business model.

If your goal is quick validation, it’s fine.

If your goal is scale, stability, and brand value — delaying GST only delays growth.

Yes. Dropshipping without GST is legal if your annual turnover is below the GST exemption limit and you sell through your own website or social media, not on GST-mandatory marketplaces like Amazon or Flipkart.

The GST exemption limit in India is ₹40 lakh for goods and ₹20 lakh for services. If your dropshipping turnover stays below this limit, GST registration is not mandatory.

No. GST is not mandatory for dropshipping websites if you sell on your own site, operate within India, and remain below the GST exemption threshold.

No. Amazon, Flipkart, and other major marketplaces require GST registration for all sellers, regardless of turnover.

Yes, you can dropship from Indian suppliers without GST if your turnover is below the exemption limit. However, some suppliers may prefer working with GST-registered sellers.